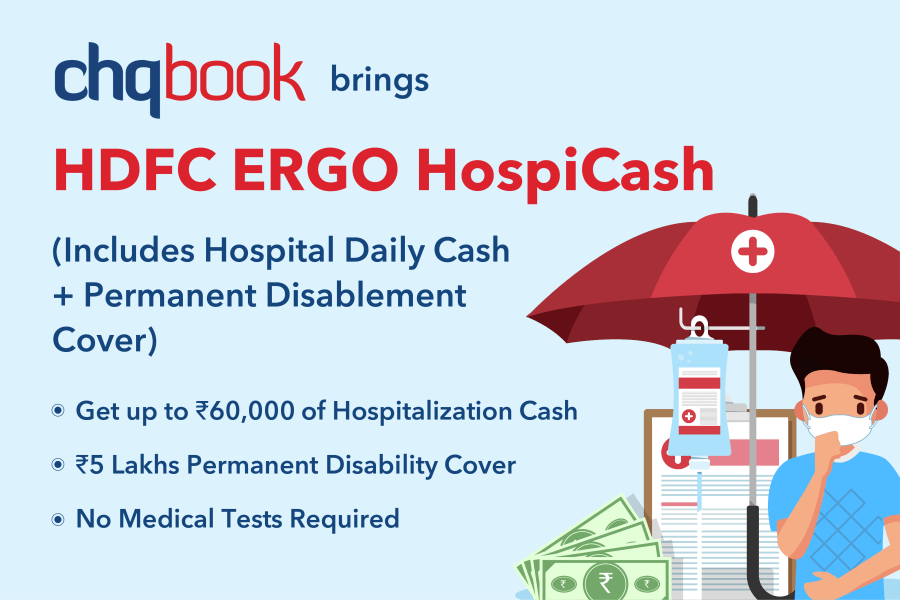

This plan can only be purchased through the Chqbook App at a nominal premium of INR 599/- (inclusive of GST) for one policy year. To buy this plan, click here

Frequently Asked Questions (FAQs)

Hospital Daily Cash Insurance:

Q.1. What is Hospital Daily Cash?

A. It is a fixed amount paid for each day that you are hospitalized. Minimum 24 hours of hospitalization is mandatory to avail this benefit. The amount is fixed and doesn’t change during the policy term.

Q.2 What is covered under Hospital Daily Cash Benefit?

A. This provides a fixed amount paid for each day of hospitalization and this amount can be used as per the insured’s need. This amount can be used for meeting expenses that are usually not covered under a standard health insurance policy. The amount paid can be used for compensating loss of income during the period of hospitalization

Q.3 How much Hospital Cash benefit is payable under this plan?

A. Under this plan, the total sum insured is INR 60,000 for 1 policy year. This sum insured is paid to you as a daily fixed cash benefit of INR 2,000 for a maximum of 30 days of hospitalization. There is a deductible of 1 day applicable on each claim.

Q.4 How many times can I claim the Hospital Cash Benefit?

A. You can raise multiple claims in one policy year, but the total number of days for which the daily cash benefit will be payable will not be more than a maximum of 30 days of hospitalization.

Q.5 Is hospitalization mandatory for the Hospital Cash benefit to be paid?

A. Yes. A minimum of 24 hours in-patient hospitalization is mandatory to claim this benefit.

Q.6 Is there any deductible in this policy?

A. There is a deductible of 1 day applicable to each claim. For example, if a claim is raised for 3 days of hospitalization, benefit will be paid for 2 days. Similarly, if a claim is raised for 1 day of hospitalization, no benefit will be payable.

Q.7 Is Hospital Cash benefit payable for hospitalization outside India?

A. No. It is strictly applicable for hospitalization within India only.

Q.8 Are pre-existing diseases covered?

A. Yes. Pre-existing diseases are not covered in the first 30 days after the date of policy issuance. They will be covered from Day 31 onwards.

Q.9 Is there any waiting period?

A. Yes. There is a waiting period of 30 days applicable before you can claim Hospital daily cash benefit. This means any claim raised within 30 days from policy issuance will not be payable.

Permanent Disability Cover:

Q.1 What is Personal Accident Insurance Coverage?

A. Accidents can happen any time and they create serious financial issues for the injured and their dependents. In order to cover such mishaps, this policy provides complete cover in the event of disablement of the insured due to accidents occurring anywhere in the world.

Q.2 What is the Personal Accident Insurance coverage under this plan?

A. INR 5 Lakh is sum insured for one policy year. Benefit is paid as shown in table below:

| S. No | Disablement | Sum Insured Payable |

| 1 | Permanent Total Disablement | 100% |

| 2 | Permanent & Incurable insanity | 100% |

| 3 | Permanent total loss of two limbs | 100% |

| 4 | Permanent Total Loss of Sight in both eyes | 100% |

| 5 | Permanent Total Loss of Sight of one eye and one Limb | 100% |

| 6 | Permanent Total Loss of Speech | 100% |

| 7 | Complete removal of the lower jaw | 100% |

| 8 | Permanent Total Loss of Mastication | 100% |

| 9 | Permanent Total Loss of the central nervous system or the thorax and all abdominal organs resulting in the complete inability to engage in any job and the inability to carry out Daily Activities essential to life without full-time assistance | 100% |

| 10 | Permanent Total Loss of Hearing in both ears | 75% |

| 11 | Permanent Total Loss of one Limb | 50% |

| 12 | Permanent Total Loss of Sight of one eye | 50% |

Q.3 Is there any death benefit payable under this plan?

A. No. The benefit is only limited to the disablement arising out of accident and payable as per the table shown above.

Q.4 Is Personal Accident Coverage applicable outside India?

A. Yes, personal Accident Coverage is applicable worldwide.

Q.5 Is the waiting period of 30 days applicable for Personal Accident Coverage benefit?

A. No, the waiting period doesn’t apply for Personal Accident Cover.

Policy Servicing and Claims Related:

Q.1 Who is eligible to purchase this plan?

A. A registered Chqbook User can purchase this plan through the Chqbook App. All users aged between 18 and 65 years can purchase this plan for themselves. The plan can be purchased only once by each user.

Q.2 What are the exclusions in this policy?

A. Exclusion List is as stated below. For the complete list of exclusions, please refer to the policy wording.

- Maternity related Hospitalization is not covered.

- Personal Accident Cover will not be paid for Bodily Injury sustained whilst or as a result of riding or driving a motorcycle or motor scooter over 150 cc.

- Injury caused by surgery

- Nuclear energy risk

- Professional activities of military personnel

- Offshore activities

- Bodily Injury or Sickness occasioned by Civil War or Foreign War.

- Bodily Injury or Sickness caused or provoked intentionally by the Insured Person.

- Injury or Disease directly or indirectly caused by or contributed to by nuclear weapons/ materials.

- Bodily Injury or Sickness due to wilful or deliberate exposure to danger, (except in an attempt to save human life), intentional self-inflicted injury, suicide or attempt thereat, or arising out of non-adherence to Medical Advice.

- Bodily Injury or Sickness sustained or suffered whilst the Insured Person is or as a result of the Insured Person being under the influence of alcohol or drugs or narcotics unless professionally administered by a Physician or unless professionally prescribed by and taken in accordance with the directions of a Physician.

- Bodily Injury due to a gradually operating cause.

- Bodily Injury sustained whilst or as a result of participating in any sport as a professional player.

- Bodily Injury sustained whilst or as a result of participating in any competition involving the utilization of a motorized land, water or air vehicle.

- Bodily Injury whilst the Insured Person is travelling by air other than as a fare paying passenger on an aircraft registered to an airline company for the transport of paying passengers on regular and published scheduled routes.

- Bodily Injury sustained whilst or as a result of participating in any criminal act.

- You can intimate the claim by uploading the required documents on HDFC ERGO Portal : https://www.hdfcergo.com/claim/register-health-insurance-claim

- You may also write to healthclaims@hdfcergo.com

- Claim must be intimated within 30 days

- All claim related forms are available at www.hdfcergo.com

- Duly filled and signed Claim Form with HDFC ERGO policy number Claim Form (Form C for Hospital Cash and Form A for Personal Accident Cover)

- Hospital Discharge Summary, Police FIR, if accident is reported to Police

- Medical papers, pathology reports, X-ray reports, if applicable

- For Permanent Disability Claims, disability certificate from reputed surgeon or Municipal Hospital

- Case specific, additional documents may be required

- Claims Service Representative will guide you on the claim procedures and documents required

- Customer will be updated through SMS/email on every stage of the claim

A. After purchasing the plan, HDFC Ergo General Insurance will issue a Certificate of Insurance (COI) within 5 working days on your registered email id.

Disclaimer *Nineroot Technologies Pvt Ltd is the master policyholder of Sarv Suraksha Plus(Group) offered by HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400020. For more details on the risk factors, terms and conditions, please read the sales brochure/ prospectus before concluding the sale. Sarv Suraksha Plus(Group)- UIN- HDFHLGP21002V022122